Geezeo’s Perks

The Great Geezeo Bailout includes a whole list of prizes for the site’s users, all geared toward improving those users’ finances. The largest prize is $6,000 intended to cover a few months worth of mortgage payments or help a user get out of debt. But there are other prizes up for grabs:

12 months of identity protection from Identity Guard $1,000 investment account from Trade Monster $500 lending account from Lending Club

To be eligible for Geezeo’s bailout package, users have to login into Geezeo between now and March 31, 2009 — and you receive one entry into the sweepstakes for every day you login during the contest period.

But Is Geezeo Worth Your While?

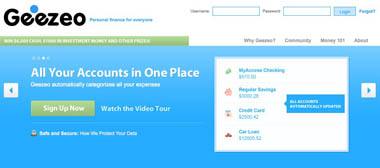

It’s all well and good for a website to give away money. But what makes Geezeo any different from the lists of other online money management tools? There are plenty of similarities, of course: once you’ve created an account on Geezeo, you can import the information from your variety of bank and credit card accounts. The site can categorize purchases, helping you to see just where you money is going. And you can easily set a budget based on your goals and your past expenses. But that’s where Geezeo starts to split off from the rest of the pack. Geezeo places a huge emphasis on community, drawing a comparison from dieting: for most people, dieting is much easier when they’re on the buddy system. Geezeo holds that the same is true in paying off debt and meeting financial goals. Once you have a profile in place, you can join groups, share goals (and progress) and even take your efforts a step further. You can share your financial confessions on the site — you can share where you’re having problems and get reassurance that your struggles with money aren’t unusual. The Geezeo community is more than a support structure, though. It provides access to tips in specific area and help from both other users — people who have already been in the position you’re working on — as well as from experts who administer groups that cover specific topics. Those experts are full participants on Geezeo, as well. They routinely share goals and confessions of their own. The last unusual component to Geezeo is the site’s public feed: it’s a real-time look at what Geezeo members are doing. Whether they’re creating goals, posting questions or making purchases, as long as users have chosen to share their profiles, you can see the steps that they’re taking to get their finances on solid ground. While it may seem on the surface that the public feed is simply a community-building tool, it actually has a lot of value for helping users move forward on their finances. It’s easy to get ideas on how to proceed on your own goals (or even an idea of what your goals might be) by seeing what other people are doing.

Geezeo’s Security

I’ve long been concerned with the security of personal finance websites. Handing over pretty much all of your financial information to a website, no matter how many cool tools or perks it offers, requires a little more information. Geezeo has made an explanation of its security measures available on its website. This personal finance site has taken some very reasonable measures to protect information, including using both SSL and SSH to transmit information and storing a minimal amount of data. The security policy even explains that Geezeo’s developers have taken extensive steps (including filtering information out of their system logs) to ensure that even they can’t access a user’s information. Because I’m not be entirely sold on the idea of sharing all my personal information with the entirety of the Geezeo network, I’m comforted by the fact that the site’s security policy specifically states that users’ actual balances are never shared. I also like the fact that Geezeo makes a point of never selling your data to a third party: there are more than a few financial sites that have turned sharing your information — prequalifying you for loans, for instance — into a feature of their sites as well as a main method of monetization. Geezeo does provide a marketplace, where you can browse through financial products, but the decision to do so is entirely up to the user.

Should You Switch To Geezeo?

If you’ve been trying to decide on a tool to manage your money, Geezeo is likely to be a good option — and its bailout sweepstakes does add a little extra incentive. If you’ve been working with a particular tool, I wouldn’t necessarily recommend making a switch, though. The important thing about any personal finance tool is whether it works for you: you don’t need an account on every shiny money management website, even if you manage to maintain multiple social networking profiles. I know that Geezeo’s social nature isn’t a positive for everyone. If you aren’t entirely comfortable with sharing even a few details with the rest of the internet, you do have the option to keep your information private — and there are plenty of other money management tools that might serve you better. If you have any experiences with Geezeo that you would like to share, please share them in the comments.